Living on the Age Pension: Budgeting Tips and Real-World Costs

As of 2025, the full Age Pension for a single person from Centrelink is around $1,116.30 per fortnight, or about $29,000 a year, including the Pension Supplement and Energy Supplement. For many older Australians, this is the main or only source of income in retirement.

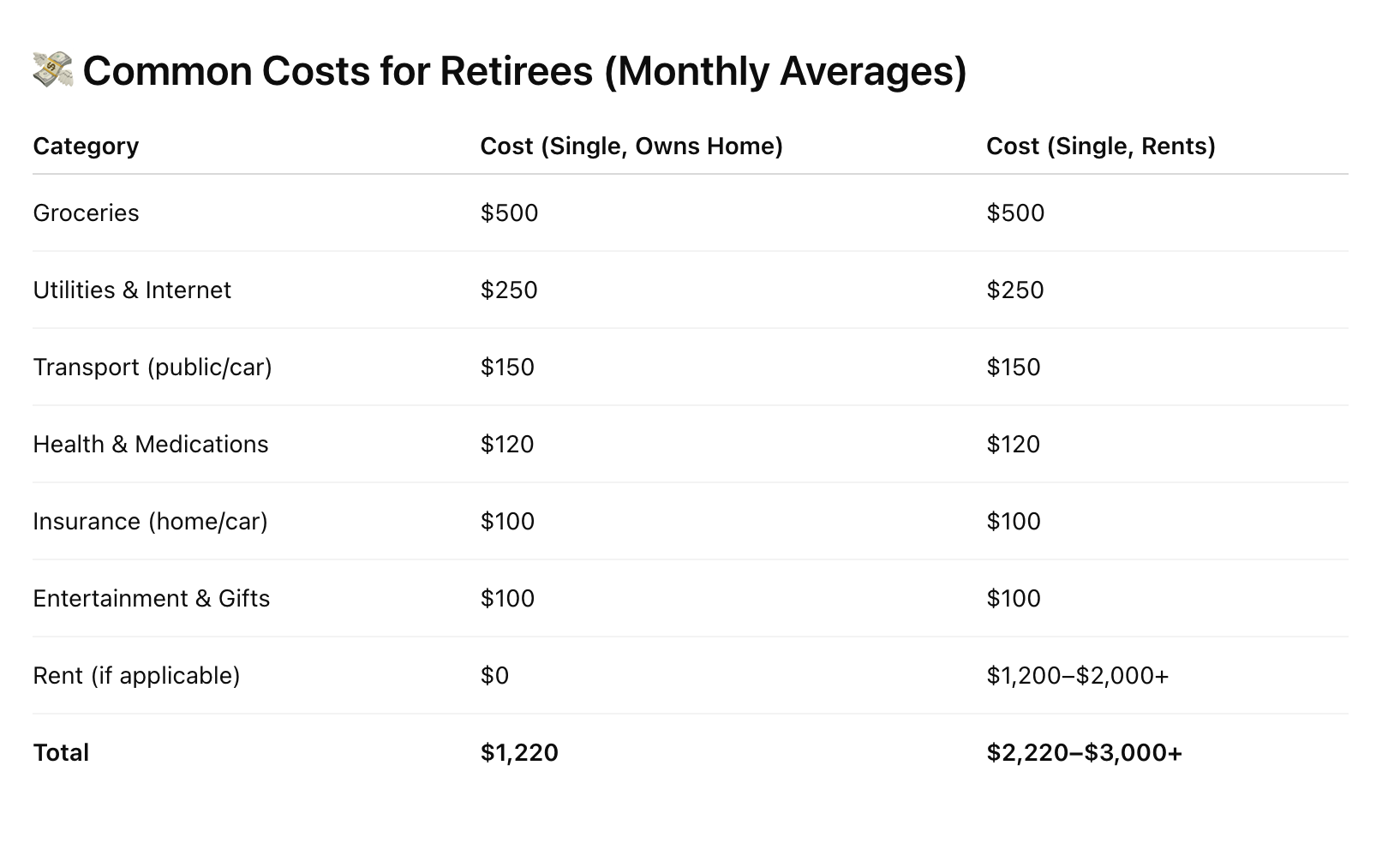

But is it enough to live on? The short answer: it depends on your lifestyle, location, and whether you own your home. Here’s a breakdown of real-world costs and some practical budgeting tips to help you make the most of every dollar.

✅ The Reality: Can You Live on the Age Pension Alone?

For those who own their home outright, the Age Pension can cover basic living expenses — but there’s little room for extras. If you’re renting, especially in major cities, things can get very tight, even with Rent Assistance.

According to the Association of Superannuation Funds of Australia (ASFA), a "modest" retirement lifestyle (for home-owners) costs about $32,000 per year for a single person. That’s more than the full Age Pension alone.

🧠 Smart Budgeting Tips

1. Know What You’re Entitled To

Check for additional benefits like:

Rent Assistance

Concessions on electricity, gas, water, rates, and transport

Pharmaceutical Benefits Scheme (PBS) discounts

Seniors Health Card or Pensioner Concession Card

2. Track Spending

Use a budgeting app (like MoneySmart’s Budget Planner) or notebook to track every dollar. Small leaks add up fast.

3. Cut Non-Essentials, Not Joy

Look for free entertainment — libraries, community centres, walking groups. Many councils run free or discounted senior activities.

4. Downsize (If It Makes Sense)

Selling a larger home and moving to a smaller one (or a regional area) can free up money — but be aware of how this affects your assets test.

5. Use the Work Bonus

You can earn up to $300 per fortnight (as of 2025) without it affecting your pension, thanks to Centrelink’s Work Bonus. Great if you want to do casual or part-time work.

🏡 Renters: Take Extra Care

The Age Pension was not designed with today’s housing market in mind. If you rent privately, particularly in capital cities, you may be forced to spend over 50% of your income on rent — which is considered rental stress.

Options to explore:

Apply for public housing or community housing (waiting lists can be long)

Look into shared accommodation with other seniors

Consider regional towns with lower rent and good services

📌 Final Thoughts

Living solely on the Age Pension is challenging, but many Australians manage with careful planning, strong budgeting, and a bit of help from Centrelink and community resources. It may not offer a lavish retirement, but with the right strategies, it can still be a secure and satisfying one.

✅ Need Help Applying for the Age Pension?

Struggling with the Centrelink Age Pension application process? You're not alone. Our expert Age Pension consultants offer friendly, step-by-step support to make things easier.

Whether you need:

Help with your Age Pension application

Assistance filling out the Age Pension form

Or general Centrelink Age Pension help — we’re here for you.

👉 Apply for Age Pension assistance today and get peace of mind knowing your claim is in good hands.

📞 Call us or book your Age Pension application service now.